This post contains affiliate links, which means I may receive a small commission, at no cost to you, if you make a purchase through a link.

You’re reading this article right now because you want to discover how to trick yourself into saving money, right? Because as we all know, saving money is easier said than done…

Does this sound familiar? You declare to yourself “I’m going to save $3000 in 3 months.” But before you know it, 2 months have passed and your savings have increased by exactly $0…

If so, don’t worry – you’re not alone. There’s a reason why 58% of Americans have less than $1000 in savings – because saving money can be hard!

Saving money requires discipline but there are various ways to trick yourself into saving money. Here are 7 proven ways…

How to Trick Yourself Into Saving Money – 9 Proven Ways That Actually Work

Set Up an Automatic Transfer

The easiest and most effective way to trick yourself into saving money is by setting up an automatic transfer from your checking account to your savings account every pay period.

This concept, popularized in the book “Automatic Millionaire,”is also known as “paying yourself first.”

The idea is most people who are trying to save money will save what’s left AFTER they’ve bought and paid for everything else. This usually means very little money ends up getting saved.

By paying yourself first, you’re reducing the temptation to spend more than is necessary.

Why?

Because the money is gone from your checking account before you even notice it was there.

A lot of banks allow you to set up automatic transfers online. Otherwise, go into your local branch to get everything set up.

Start a Change Jar (That You Can’t Open)

You may not have had a change since you were in grade school, but don’t write them off. Change jars can be an excellent tool to trick yourself into the saving money.

The key to success is making sure your change jar isn’t easy to open (so don’t use a mason jar!) I recommend purchasing a coin bank like this one that doesn’t have an opening at the bottom, to help avoid any temptation.

I recently purchased this coin bank from my local Daiso store here in Japan.

At the end of the day, I check my wallet for 500 yen coins and if I have any, they go straight into my coin bank. Once the coin bank is full, I’ll have 300,000 yen saved up (which is about $2800 USD.)

You can set up your coin bank “system” however you’d like – I also have a separate coin bank that I empty everything (besides 500 yen coins) into every Sunday evening.

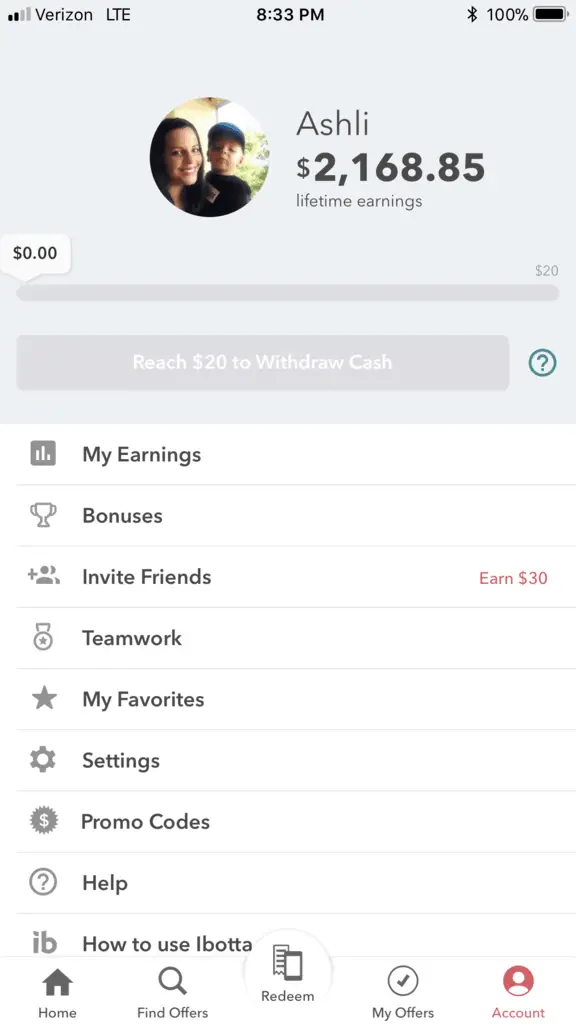

Join Ibotta

One of my favorite ways to save money is using the free cash back app, Ibotta. This is free money for doing something that we all do (grocery shop.) The money you earn from Ibotta can be a great way to boost your savings account.

Here’s how it works:

Do your grocery shopping, log into the app and find matching cash back offers to redeem, snap a copy of your receipt and you’re done. Within 24 hours, you’ll receive your cash back reward.

Once you’ve reached $20 you can exchange it for cash or a gift card. Click here to join Ibotta and get a bonus $10.

(You can also earn $5 for every friend you refer to the app so sign up, get your referral link and start sharing! I’ve made over $2000 with Ibotta from claiming cash back rewards and sharing my referral link. Click here to get started.)

Set a Specific Goal

Tricking yourself into saving money can be as simple as setting a specific savings goal.

Think back to when you were a kid… If your mom asked you to vacuum the living room, you weren’t too keen on the idea, right? But what if she said “vacuum the living room for the next 4 weeks and I’ll give you $10” (i.e. bribed you.) Then vacuuming the living room didn’t sound too difficult, did it?

That’s because you had a goal – earning that sweet 10 bucks!

Setting a savings goal can work in the same way.

Here’s an example:

Maybe you want a shiny new MacBook and you’ve figured out it’s going to cost you $2000. Set a savings goal of $3000. Once you’ve reached your goal, go and buy your new MacBook and save the extra $1000.

Use Acorns

Acorns is an investment app that makes it easy to trick yourself into saving money, because it saves money for you on autopilot.

Here’s how it works:

Acorns “round up” feature works the same as saving your spare change at the end of the day, except it’s done every time you make a debit card purchase.

Whenever you swipe your debit card, Acorns rounds your purchase up to the next dollar and then invests that money for you.

For example, if you spend $4.20 at the convenience store, Acorns will round your purchase up to $5 and invest the $0.80 for you.

If you use your debit card regularly, Acorns can be an excellent tool to help you increase your savings on autopilot. Click here to join Acorns and get a $5 bonus.

Start a 52-Week Savings Challenge

A 52-week savings challenge is one of the best ways to trick yourself into saving money, because once you’ve completed the challenge you’ve gotten into the habit of saving (which means you no longer have to “trick” yourself!)

This 52-week money saving challenge includes a free printable and at the end of the challenge, you’ll have increased your savings by $3000.

You’ll also find plenty of ideas on how to make money and cut expenses to help you complete the challenge. Click here to check it out.

Wait 48 Hours Before a Purchase

How many times have you gone to Target to buy one thing and ended up coming home with 10 things you didn’t need?

Impulse shopping can put a HUGE dent in your budget and make it very difficult to reach your savings goals.

One of the best ways to stop yourself from impulse shopping is to put in place a “48 hour rule.”

Every time you’re tempted to make an impulse buy, wait 48 hours. If the desire is still there (and it’s in your budget) then go ahead and buy the item.

But chances are, you’ve forgotten what it was after 48 hours (which means you didn’t need it and you’ve saved money!)

Earn Cash Back With Rakuten

If you do a lot of online shopping and you’re not using Rakuten to earn cash back, then you’re missing out on free money.

Rakuten makes saving money easy. Every time you shop online, go to Rakuten.com then click on the link to whatever store you want to shop at.

Rakuten will track your purchase and give you a percentage of the total purchase price in cash back. Every 3 months, you’ll receive a “Big Fat Check” in the mail for doing nothing other than shopping online.

Click here to join Rakuten and get a bonus $10.

Calculate Required Work Hours

This has always been one of my favorite ways to trick myself into saving money, and it works a charm.

Before making a purchase, stop for a second and figure out how many hours you’ll need to work to pay for said item.

For example, if you’re tempted to buy a $100 pair of jeans and you make $20/hr, you’ll need to work 5 hours (more, when you factor in taxes) to pay for those jeans.

Are those jeans really worth FIVE HOURS at work? Whenever I think of it that way, the answer is almost always a big NO.

Other Articles You Might Like:

- The Best Apps to Make Money in 2019

- How to Make $200 Fast

- How to Make Money Watching TV

- 10 Habits That Will Make You Rich

- 41 Legitimate Work From Home Jobs That Pay Well

Рестраця на Binance

Thursday 21st of December 2023

Thanks for sharing. I read many of your blog posts, cool, your blog is very good. https://accounts.binance.com/uk-UA/register-person?ref=JHQQKNKN

20bet

Saturday 7th of October 2023

Your article gave me a lot of inspiration, I hope you can explain your point of view in more detail, because I have some doubts, thank you. 20bet

20bet

Friday 29th of September 2023

Apoiar ferramentas de apostas e estar equipado com uma plataforma diversificada de transações financeiras, a 20Bet oferece suporte tangível aos jogadores. Este é um lugar onde eles podem apostar com dinheiro real, respaldados por concorrentes de diversas disciplinas esportivas. 20bet

binance atvērt kontu

Monday 15th of May 2023

Thanks for sharing. I read many of your blog posts, cool, your blog is very good. https://accounts.binance.com/lv/register-person?ref=B4EPR6J0

Registrera dig

Monday 8th of May 2023

Your point of view caught my eye and was very interesting. Thanks. I have a question for you. https://www.binance.com/sv/register?ref=PORL8W0Z